The Toronto Maple Leafs face a pivotal 2025 offseason. This period promises significant decisions regarding roster construction. It also involves crucial choices about salary cap management. As General Manager Brad Treliving aims to reshape the team, he may alter its “DNA.” Every tool in the collective bargaining agreement comes under consideration. One such tool, often debated among fans and analysts, is the contract buyout. This report explores the mechanics of NHL buyouts. It analyzes the Maple Leafs’ cap situation. The report evaluates potential candidates for this contract termination mechanism. It also considers alternatives and the latest strategic whispers emerging from the organization.

Section 1: The NHL Buyout: A Primer for Leafs Nation

A contract buyout in the National Hockey League is a mechanism. It allows a team to terminate a player’s Standard Player Contract (SPC) before its scheduled expiry. Teams typically consider this option to gain relief from the player’s salary cap hit. They often do so due to underperformance relative to the player’s contract. Alternatively, they may use it to free up a roster spot for other players. For a team like the Maple Leafs, buyouts could provide flexibility. They could help in re-signing key free agents. Additionally, this could facilitate acquiring new talent that better fits the evolving team philosophy.

Understanding the intricacies of the NHL’s buyout rules is crucial before assessing any potential candidates:

- Eligibility: A player must first clear unconditional waivers to be eligible for a buyout. Critically, players who are legitimately injured cannot be bought out by their teams.

- Calculation Based on Age: The financial impact of a buyout varies significantly. It depends on the player’s age at the time of the buyout.

- For players under 26 years old, the buyout cost is 1/3 of the remaining base salary.

- For players 26 years old or older, the buyout cost is 2/3 of the remaining base salary.

- Impact of Signing Bonuses: Signing bonuses are considered “buyout-proof.” This means players receive the full amount of any owed signing bonuses regardless of a buyout. These bonuses are excluded from the 1/3 or 2/3 buyout calculation applied to the base salary. However, they are still paid out by the team. This distinction is vital. A contract heavily weighted with signing bonuses might offer less actual cash savings to the club. This is less than what the cap relief might suggest. The team remains responsible for these bonus payments. This may diminish the financial appeal of a buyout from a pure cash-flow perspective. It could also steer them towards trade solutions, even if salary retention is involved.

- Buyout Duration: The total buyout cost, which is 1/3 or 2/3 of the remaining base salary, is divided. This amount is spread over twice the number of remaining years on the contract. This structure provides immediate, partial cap relief. It extends the team’s financial obligation, albeit at a reduced annual rate. This creates a longer-term dead cap charge.

- Cap Hit Calculation: The annual cap hit of a buyout is calculated year by year. To understand the resulting cap hit for a given year, start with the Original Average Annual Value (AAV). Subtract the Base Salary for that year. Add the Annual Buyout Cost, which is the spread-out portion of the 1/3 or 2/3 base salary cost. This sum equals the Buyout Cap Hit for that year. This formula reflects the savings from not paying the full base salary, offset by the new, annualized buyout charge.

- Buyout Window: There are specific periods when teams can execute buyouts.

- The primary buyout window opens on the later of June 15 or 48 hours after the Stanley Cup Final concludes. It closes on June 30 at 5 p.m. Eastern Time. The timing of this window is strategically significant. It forces teams to make buyout decisions before the NHL Draft and the opening of free agency (typically July 1st). This situation involves a calculated risk. A team might buy out a player to create cap space for a specific free-agent target. However, that target might sign elsewhere. This leaves the team with dead cap space and a roster hole. Conversely, failing to act could mean missing an opportunity due to insufficient cap space.

- A second buyout window can open for a team if it has a player file for salary arbitration. This happens when the case is either settled or an award is rendered. This window lasts 48 hours and begins three days after the arbitration settlement or award. However, only contracts for players with cap hits greater than $4 million are eligible during this second window. Players must have been on the team’s roster at the last trade deadline.

The age distinction in buyout calculations also presents a unique dynamic. A buyout provides a greater percentage of cap relief for a younger player relative to the remaining base salary. It costs only 1/3. However, problematic contracts are more frequently held by older, veteran players. This means it’s easiest to gain significant cap relief from certain players. However, these players are often not the ones teams are most desperate to move. Conversely, older, more expensive players yield proportionally less relief (costing 2/3) and result in a higher actual buyout cost.

Section 2: Setting the Stage: Toronto’s 2025 Offseason Cap Picture

We need to examine the Maple Leafs’ salary cap situation heading into the 2025-26 season. This will help understand why buyouts might even be a topic of discussion. The NHL and NHLPA have provided some predictability. They announced that the Upper Limit of the salary cap for the 2025-26 season will be $95.5 million.

As of early June 2025, PuckPedia projects the Maple Leafs to have $25,709,001 in available cap space. They have 17 players under contract for the 2025-26 season. The projected cap hit is $69,790,999. This figure also accounts for a bonus carryover overage of $626,230 from the previous season.

This available space is before addressing several key pending free agents whose contracts expire after the 2024-25 season:

- Unrestricted Free Agents (UFAs): Mitchell Marner, John Tavares, Max Pacioretty, and Steven Lorentz.

- Restricted Free Agents (RFAs): Matthew Knies, Nicholas Robertson, and Pontus Holmberg.

The negotiations with Marner and Tavares, in particular, will dominate the Leafs’ offseason. Marner’s current AAV is $10.903 million, and Tavares’s is $11 million. Even if Tavares accepts a significant pay cut, these two contracts alone could take a large part. If Marner re-signs, it is still uncertain. These could consume a substantial portion of the available $25.7 million. Matthew Knies will receive a substantial raise from his entry-level contract. Some projections suggest a long-term deal could approach $8 million AAV. Alternatively, a bridge deal could be in the $4-5 million range.

Table: Maple Leafs’ Projected 2025-26 Salary Cap Situation (Pre-UFA/RFA Signings)

| Category | Value |

|---|---|

| NHL Salary Cap Upper Limit | $95,500,000 |

| Leafs Projected Cap Hit (17 players) | $69,790,999 |

| Leafs Projected Cap Space | $25,709,001 |

| Bonus Carryover Overage | $626,230 |

| Key Pending UFAs (2024-25 AAV): | |

| Mitchell Marner | $10,903,000 |

| John Tavares | $11,000,000 |

| Key Pending RFAs (2024-25 AAV): | |

| Matthew Knies | $925,000 |

| Nicholas Robertson | $875,000 |

| Pontus Holmberg | $800,000 |

This financial landscape underscores the challenge for GM Brad Treliving. The Leafs’ approach to buyouts or other cap-clearing measures is directly tied to the outcomes of these primary negotiations. Their aggressiveness in these pursuits will depend on the negotiation results. If Marner and Tavares are retained at high figures, and Knies signs a lucrative extension, the $25.7 million in cap space could evaporate quickly, necessitating moves to shed salary. Conversely, if Marner departs, the immediate cap pressure might lessen for bottom-six buyouts. However, it creates a massive on-ice hole to fill.

The rising salary cap offers a double-edged sword. While the cap is projected to increase to $104 million in 2026-27 and $113.5 million in 2027-28 , providing more future spending power, it also empowers player agents to demand higher AAVs. Marner’s camp, for instance, would likely be emboldened by these projections. Thus, while the Leafs gain more room, the cost of retaining their own free agents might inflate proportionally. This inflation could negate some benefits. It could also affect savings they are attempting to extract from other existing contracts.

Section 3: The Candidates: Who’s on the Buyout Chopping Block?

Several players on the Maple Leafs’ roster have been mentioned as potential buyout candidates. This is mainly due to their performance relative to their cap hit. Other reasons include changes in their role on the depth chart or a broader strategic shift by the organization. The primary names that have surfaced are David Kämpf, Calle Järnkrok, and Ryan Reaves.

The following table presents the detailed contract status for these players. It also shows the potential buyout implications if a buyout occurs in the 2025 offseason. Calculations consider the player being 26 or older. In this case, it costs 2/3 of their remaining base salary. The cost is spread over twice the remaining years. Signing bonuses are excluded from the buyout calculation but are still paid by the team.

Table: Potential Maple Leafs Buyout Candidates – Contract & Buyout Impact (2025 Offseason)

Note: Age reflects age during the 2025-26 season. Contract details primarily from PuckPedia. Buyout calculations performed as per NHL rules.

3.1 David Kämpf – Defensive Specialist, Offensive Liability?

David Kämpf, 30, is entering the third year of a four-year, $9.6 million contract ($2.4M AAV) signed in June 2023, leaving two years remaining through the 2026-27 season. For the 2025-26 season, his contract includes a $1.08 million base salary and a $1.33 million signing bonus. His deal also carries a Modified No-Trade Clause where he submits a 10-team no-trade list for the 2025-26 season.

Kämpf was signed primarily for his defensive acumen and penalty-killing abilities, not for offensive production. In the 2024-25 season, he registered 5 goals and 8 assists for a total of 13 points in 59 games. His average time on ice was 12:24. This was a notable decrease from over 15 minutes in his first two seasons with Toronto. His Corsi For percentage (CF%) was 45.7%. His role diminished significantly. This occurred particularly after the trade deadline acquisition of Scott Laughton. He was a healthy scratch for most of the 2025 playoffs, if not all.

A buyout of Kämpf’s contract would involve the remaining two years of base salary ($1.08M for 2025-26 and $1.08M for 2026-27, totaling $2.16M). At 2/3 cost, the total buyout amount paid by the Leafs would be $1,440,000, spread over four years ($360,000 annually).

- For 2025-26 and 2026-27: The buyout cap hit would be $1,680,000 each year ($2.4M AAV – $1.08M Base + $360,000 Annual Buyout Cost). This would result in a cap saving of $720,000 for each of these two seasons.

- For 2027-28 and 2028-29: The Leafs would carry a dead cap hit of $360,000 each year.

The significant signing bonuses of $1.33M due July 1, 2025, and another $1.33M due July 1, 2026. If he remains on the roster, the team will still pay out substantial cash regardless of a buyout. The M-NTC also adds a hurdle to a potential trade. Management must decide if the modest cap savings justify the extended dead cap. They also need to consider the immediate cash payouts of the bonuses.

3.2 Calle Järnkrok – Versatility vs. Value and Injury Concerns

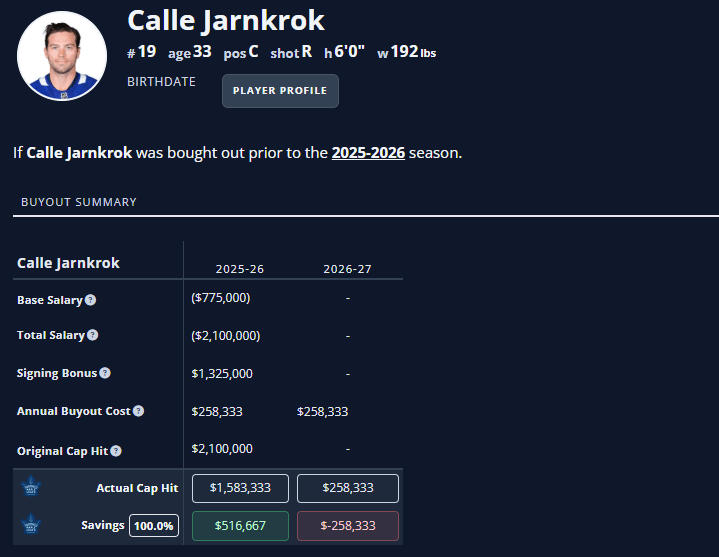

Calle Järnkrok, who will turn 34 early in the 2025-26 season, is entering the final year of his four-year, $8.4 million contract ($2.1M AAV). His 2025-26 salary structure consists of a $775,000 base salary and a $1,325,000 signing bonus, due July 1, 2025. His contract also includes a Modified NTC (10-team no-trade list).

Järnkrok is known as a versatile forward capable of playing center or wing and contributing to the penalty kill. However, his recent tenure has been marred by injuries. He played only 19 games in the 2024-25 season. He tallied 1 goal and 6 assists for 7 points. This was due to a groin injury and subsequent sports hernia surgery. Some analysts note he has had a “difficult time staying healthy.” They also believe he “makes far too much money for the role he plays.” Meanwhile, others have described his on-ice impact as an “NPC in a game set on medium difficulty.” His role could potentially be filled by other returning depth players.

A buyout for Järnkrok has one year of base salary remaining, which is $775,000. It would cost the Leafs 2/3 of that amount. This equals $516,667. This would be spread over two years ($258,333 annually).

- For 2025-26: The buyout cap hit would be $1,583,333 ($2.1M AAV – $775,000 Base + $258,333 Annual Buyout Cost). This yields a cap saving of $516,667.

- For 2026-27: The Leafs would have a dead cap hit of $258,333.

The large signing bonus due on July 1, 2025, is a key factor. If a trade is pursued, it becomes more appealing for an acquiring team once the bonus is paid. Their actual cash outlay for Järnkrok for the season would only be his $775,000 base salary. A buyout offers modest savings. It also provides a shorter dead-cap tail. However, the timing of the bonus payment heavily influences the trade versus buyout calculation.

3.3 Ryan Reaves – The Enforcer’s End Game?

Veteran enforcer Ryan Reaves will be 38, turning 39 during the 2025-26 season. He is also entering the final year of his three-year, $4.05 million contract ($1.35M AAV). His contract for 2025-26 is straightforward: a $1,350,000 base salary with no signing bonuses. There are no specified trade restrictions on his contract.

Reaves played a minimal on-ice role in 2024-25. He appeared in 35 games and recorded 2 assists. He averaged just 7:48 of ice time per game. He was frequently a healthy scratch. He was placed on waivers and assigned to the AHL Toronto Marlies late in the season. While valued by some for his locker room presence, others have questioned his on-ice contributions. Some commentators describe him as “useless on the ice and waaay too slow” for the modern NHL.

A buyout of Reaves’ contract (one year, $1.35M base salary) would cost 2/3 of that amount, totaling $900,000. This would be paid over two years ($450,000 annually).

- For 2025-26: The buyout cap hit would be $450,000 ($1.35M AAV – $1.35M Base + $450,000 Annual Buyout Cost). This results in a cap saving of $900,000.

- For 2026-27: The Leafs would carry a dead cap hit of $450,000.

However, a more cap-efficient alternative exists for Reaves: AHL demotion. If Reaves is assigned to the Marlies, a significant portion of his $1.35M cap hit can be buried. Based on 2024-25 rules (league minimum plus $375,000), this could result in approximately $1.15 million in cap savings for 2025-26. There would only be a $200,000 dead cap hit for that season. Crucially, there is no dead cap hit for 2026-27. Retirement is another possibility that has been mentioned. Given the superior cap relief from an AHL demotion, a buyout seems less logical for Reaves.

3.4 The Long Shots – Why Some Names are Unlikely Targets

Fan discussions and media speculation sometimes touch on more prominent names. However, certain players are highly unlikely buyout candidates. This is due to contractual and financial realities.

- Morgan Rielly: Despite some uneven play and a contract that runs for five more seasons after 2024-25 at a $7.5 million AAV , a buyout is not a realistic scenario. Rielly possesses a full No-Movement Clause (NMC) for the majority of his remaining term. He is reportedly unwilling to waive it. Furthermore, the buyout cost would be prohibitively large and spread over a decade (e.g., a 10-year buyout costing $21.3 million in cash for $10.6 million in overall cap savings, as one calculation suggested ). This is not a financially prudent move for a player still considered a key part of the defense corps.

- Max Domi: Signed through the 2027-28 season at a $3.75 million AAV , buying out Domi just one year into his deal would be considered “horrible asset management”. The resulting dead cap penalty would be lengthy and counterproductive for a player the team recently committed to. If his performance falters significantly, he would more likely become a trade candidate rather than an immediate buyout target.

Management is considering buyouts for players like Kämpf and Järnkrok. Even if they don’t pursue them ultimately, it reflects an attempt to avoid the sunk cost fallacy. If their current on-ice value doesn’t match their cap hit, the team should seek ways to reclaim that cap space. A contending team should explore better or cheaper options. Securing the roster spot is crucial. The NTCs held by Kämpf and Järnkrok complicate matters. These clauses potentially give them leverage. They also limit the team’s trade options. This situation could make a buyout a more forced consideration if the team is resolute on making a change.

Section 4: The Shifting Winds: Are Buyouts Losing Favor in Toronto?

The narrative around potential Maple Leafs buyouts for the 2025 offseason has seen a notable evolution in early June. Initially, reports suggested that buyouts were actively being contemplated. On June 1, Sportsnet’s Elliotte Friedman indicated that the Leafs were considering buyouts for bottom-six forwards. He named David Kämpf and Calle Järnkrok. This was part of GM Brad Treliving’s strategy to “change the DNA” of the team and reshape the forward group. This aligned with a general sentiment that underperforming players on inefficient contracts were under scrutiny.

However, just days later, Friedman’s perspective appeared to shift. During the June 5th/6th editions of the “32 Thoughts” podcast, he made a statement. He said, “I don’t think Toronto is going to do a buyout.” I don’t think they are going to go that way”. Instead, the preference seemed to be leaning towards exploring trade options for players like Kämpf and Järnkrok. This approach might require retaining some salary to avoid the long-term implications of dead cap space.

Several factors could be contributing to this potential shift in strategy:

- Long-Term Cap Health: With the NHL salary cap projected to rise significantly in the coming years ($95.5M in 2025-26, $104M in 2026-27, $113.5M in 2027-28 ), avoiding even small, lingering dead cap hits becomes more strategically valuable. Future flexibility is paramount.

- Asset Management: A trade is generally preferable to a buyout. This is true even if it only returns a late-round draft pick. It is also preferable if it involves a contract swap. A buyout yields no direct asset in return.

- Trade Market Viability: The Leafs’ management might believe there’s a reasonable chance to move these players via trade. This is particularly true for contracts with significant signing bonuses due on July 1st, like those of Kämpf and Järnkrok. Once Toronto pays these bonuses, the real cash owed for the players will decrease for the remainder of the season. This reduction in cost can potentially increase their trade appeal to an acquiring team.

- Contracts Aren’t Crippling: While the cap hits for Kämpf ($2.4M) and Järnkrok ($2.1M) might be inefficient for their current roles, they are not so exorbitant as to be crippling to the team’s overall cap structure. Management might feel the buyout savings aren’t substantial enough to justify the dead cap if other solutions can be found.

- Impact of Major Negotiations: Friedman explicitly linked the potential avoidance of buyouts to the Leafs’ negotiation strategy with John Tavares. If Tavares agrees to a new contract with a much lower AAV than before, unexpected cap flexibility could be created. His previous AAV was $11 million. This newfound room might reduce the urgency to use buyouts on players like Kämpf or Järnkrok purely for cap savings. The team can then prioritize cleaner exits like trades.

This evolving stance doesn’t necessarily mean the players in question are secure in their roster spots. Instead, it suggests re-evaluating the method of potential departure. There is a preference for solutions that offer better long-term cap health and asset return. The mandate to “change DNA” can be achieved through various avenues, including trades or AHL demotions, not solely through buyouts.

Section 5: Beyond Buyouts: Alternative Cap-Clearing Strategies

If the Maple Leafs are indeed leaning away from buyouts, they have several alternative strategies. These strategies can manage contracts and create cap flexibility.

- Trading the Candidates:

- David Kämpf & Calle Järnkrok: Both players have Modified No-Trade Clauses (10-team no-trade lists). This adds a layer of complexity. However, it does not preclude a trade. As previously noted, their trade appeal increases significantly after their July 1st signing bonuses are paid by the Leafs. At that point, Kämpf would have a remaining base salary of $1.08 million for an acquiring team in 2025-26, and Järnkrok $775,000. To facilitate a trade, Toronto might need to retain a portion of their AAV (e.g., 25-50%) or take back another contract in return. For instance, some have suggested that former GM Kyle Dubas is interested in Kämpf for the Penguins. This potential interest includes salary retention. The primary benefit of a trade is avoiding a multi-year dead cap hit. This is often the case even with retention. A trade is better than the multi-year dead cap hit that a buyout would create. The team might prefer a slightly larger dead cap hit for a shorter duration with retention on a trade. This is preferable over a smaller hit spread over more years via buyout.

- Ryan Reaves: He has a minimal on-ice role. With one year remaining and no signing bonus, a trade for a late-round pick or future considerations might be conceivable. This is possible if another team specifically values his enforcer role. However, his limited impact makes this a less probable outcome.

- AHL Demotion (Burying Contract):

- Ryan Reaves: This remains a very strong alternative to buying out Reaves. As calculated, burying his contract in the AHL could save the Leafs approximately $1.15 million against the 2025-26 cap. This leaves a $200,000 dead cap hit. This amount is superior to the $900,000 savings from a buyout. Crucially, this option avoids any dead cap hit in the 2026-27 season. A player must clear waivers before being sent to the AHL, which Reaves did late in the 2024-25 season.

- David Kämpf & Calle Järnkrok: AHL demotion is less practical for these players due to their higher cap hits. A larger portion would remain on the NHL cap. They are established NHLers with NTCs and would likely resist such a move.

- Long-Term Injured Reserve (LTIR):

- LTIR is not a proactive cap-clearing tool for healthy players. A team can exceed the salary cap by the amount of an injured player’s cap hit. This is less any existing cap space if used mid-season. This is allowed if the player is expected to miss at least 10 NHL games. They must also miss 24 days of the NHL season. This situation becomes relevant only if a player like Järnkrok, with his documented injury history, suffers another significant injury. It would need to be a long-term injury. It’s important to note that LTIR does not remove the player’s cap hit. It simply provides an allowance to exceed the cap. Furthermore, a team using LTIR does not accrue cap space during the period it is utilized.

- Mutual Contract Termination:

- This is a rare occurrence where a player and team mutually agree to terminate the contract. The player must clear unconditional waivers first. If successful, the contract is wiped from the team’s books entirely. This usually involves a negotiated financial settlement between the player and the team. It is unlikely for the primary candidates discussed. A unique situation would need to arise. This could happen if Reaves decides to retire and an agreement is reached to facilitate that.

The timing of the July 1st signing bonus payments for Kämpf and Järnkrok is significant. It acts as a sort of informal trade deadline. Teams interested in acquiring them might wait until after this date. The actual cash they would need to pay the player for the 2025-26 season would be significantly reduced. This situation might increase the number of potential suitors. If the Leafs want to move them before paying the bonus, they might need to offer more favorable terms. These terms could include higher salary retention.

Section 6: The Treliving Tightrope: Navigating the Offseason Maze

The Toronto Maple Leafs are navigating a complex offseason. The handling of potential buyout candidates serves as a microcosm of the broader strategic decisions facing the franchise. Recent insider reports from mid-June 2025 suggest a decreasing likelihood of using buyouts on players like David Kämpf. The same is true for Calle Järnkrok. The preference seems to be shifting towards exploring trades, even if salary retention is necessary, or other roster management solutions. For Ryan Reaves, an AHL demotion seems more probable than a buyout. Potential retirement is also a consideration due to the more favorable cap implications of these options.

These decisions are closely tied to GM Brad Treliving’s goal. He aims to “change the DNA” of the team. This is especially relevant within the bottom-six forward group. Players whose roles have diminished under coach Craig Berube are prime candidates for change. They may have been healthy scratches during crucial playoff games, like Kämpf. Clearing their roster spots, whether through trade, demotion, or, less likely now, buyout, creates opportunities for internal promotions of prospects. It also allows for the acquisition of new players via free agency or trade. These new players may better align with the desired team identity. They could be potentially faster, more physical, and more consistently impactful performers.

The financial flexibility gained, however modest from these specific moves, plays a crucial role. It contributes to the larger puzzle of re-signing core pieces like Auston Matthews and William Nylander (already extended). There is also potential for re-signing John Tavares and Matthew Knies, while addressing other team needs.

The NHL’s rising salary cap provides more breathing room. However, the opportunity cost of dead cap space remains a significant consideration. Even a relatively small dead cap hit from a buyout today could restrict a valuable roster move in future seasons. The same cap space might be crucial then. This long-term perspective likely fuels the preference for “cleaner” solutions like trades, if they are achievable.

The Leafs resorting to a buyout for any of these players indicates a failure. They couldn’t find a viable trade market. It shows that the player’s presence is less desirable. This remains true even at their current cap hit. The known cost and duration of a buyout are considered more favorable. It becomes a last resort when other avenues to reshape the roster and optimize cap space have been exhausted.

The summer of 2025 is undeniably pivotal for the Maple Leafs. The decisions made regarding these contracts will significantly shape the team’s trajectory. Additionally, the broader strategy for roster and cap management will have a major impact. Buyouts remain a CBA-mandated tool. However, current indications suggest a cautious approach from Toronto’s management. They prioritize trades and other maneuvers offering greater long-term cap flexibility and potential asset return. The tightrope walk between immediate competitive needs continues. Sustained cap health is crucial. The coming weeks will reveal the path chosen.

Leave a comment